Spot It. Love it. Love it.

Blog1

Unlocking Pune's Real Estate Goldmine: A Comprehensive Guide to Investment Opportunities in 2025

Pune, Maharashtra, India – May 14, 2025 – The vibrant city of Pune, a harmonious blend of rich cultural heritage and dynamic modernity, is rapidly cementing its position as a premier destination for real estate investment in India. Fueled by a robust economy, burgeoning IT and manufacturing sectors, and significant infrastructural advancements, Pune’s property market is poised for substantial growth in 2025 and beyond. This in-depth article explores the multifaceted opportunities available for discerning investors, delving into current price trends, analyzing key localities, examining the impact of upcoming industries and infrastructure, and providing actionable insights to navigate this promising landscape. Our goal is to equip you with the knowledge to make informed decisions and capitalize on the potential that Pune real estate holds.

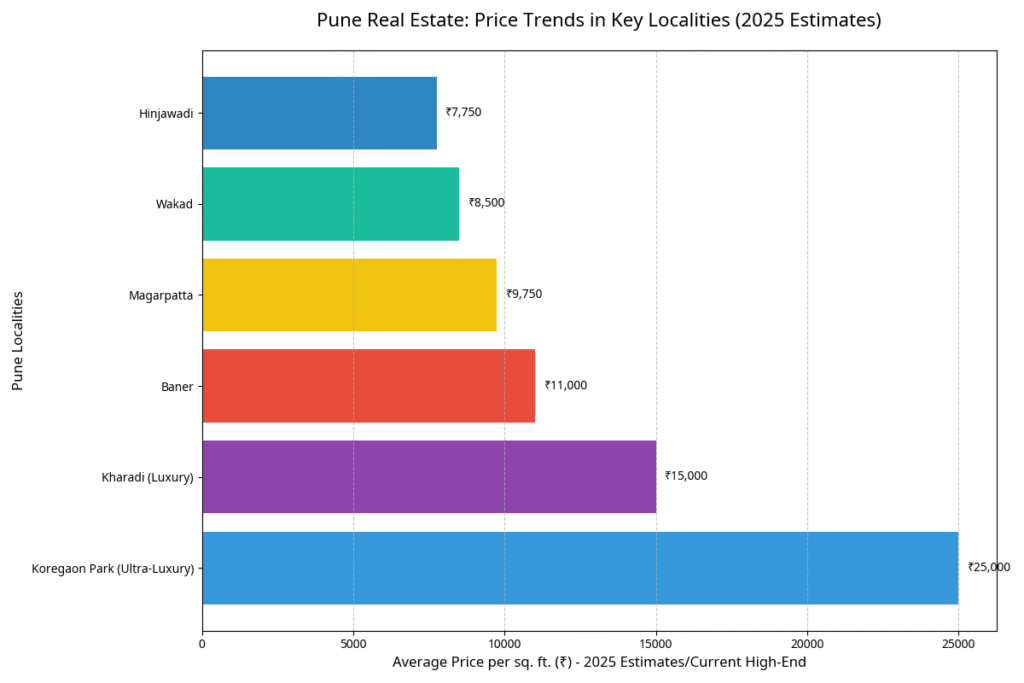

Pune Real Estate: Price Trends in Key Localities (2025 Estimates)

Why Pune? The Pillars of a Thriving Real Estate Market in 2025

A Market on the Move: Overall Growth and Investor Confidence

The Economic Powerhouse: Key Drivers Fueling Demand

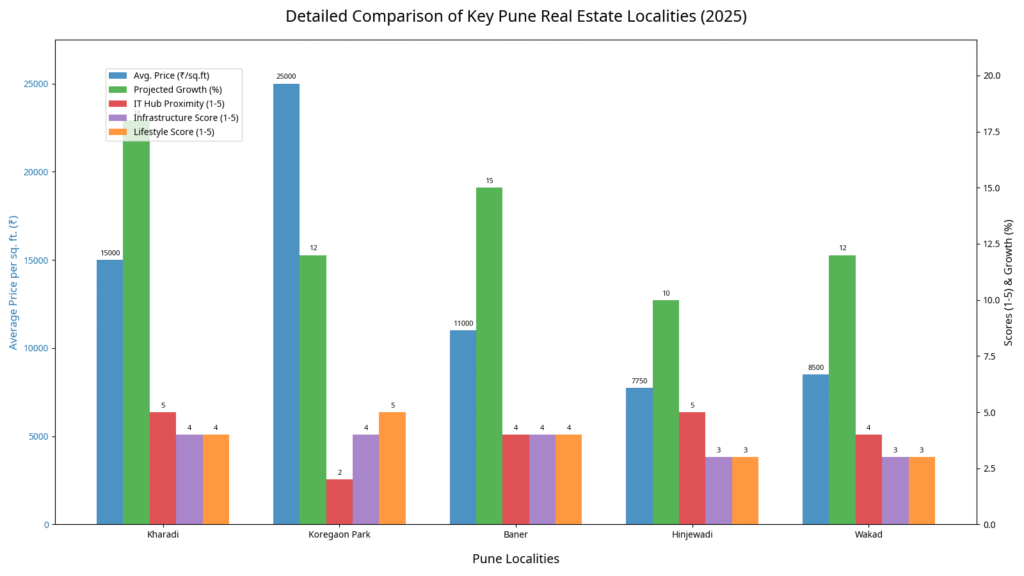

- Information Technology (IT) and ITeS: Pune is a globally recognized IT and ITeS powerhouse. The presence of sprawling IT parks such as Hinjewadi (housing giants like Infosys, TCS, Wipro), Magarpatta City (a pioneering integrated township), and Kharadi (home to EON IT Park) creates a massive influx of skilled professionals. This, in turn, generates sustained demand for residential properties, both for purchase and rental, as well as for commercial office spaces and co-working environments. The anticipated expansion of existing IT hubs and the development of new ones will only amplify this demand.

- Manufacturing and Automotive Sector: Beyond IT, Pune boasts a formidable manufacturing base, particularly in the automotive industry. Continuous investment and growth in this sector contribute significantly to employment generation, thereby fueling housing demand, especially in established industrial corridors and their adjoining residential zones.

- Educational Hub: Pune’s reputation as the “Oxford of the East” is well-earned. The city is home to numerous prestigious educational institutions, attracting a vast student population from across India and internationally. This creates a consistent and high demand for rental accommodation and ancillary services, significantly influencing property market dynamics in areas proximate to these academic centers.

The Engines of Growth: Upcoming Industries and Infrastructure Shaping Pune’s Future

Industrial Corridors and Employment Generation:

Transformative Infrastructure Projects:

- Pune Metro Rail: The phased development of the Pune Metro is a game-changer. As new lines become operational, connectivity across the city is drastically improving. Areas along these metro corridors are already witnessing heightened real estate activity, with anticipated appreciation in property values and increased rental demand due to easier commutes. Suburban and previously less accessible areas are becoming prime investment targets.

- Pune Ring Road: The proposed Pune Ring Road is another monumental project aimed at decongesting city traffic and enhancing connectivity between peripheral areas. This project is expected to unlock significant real estate potential along its alignment. Property prices in these influence zones could see an appreciation of 15-20% by 2025 as accessibility improves, spurring new commercial and residential developments.

- Road Network Enhancements: Continuous upgrades to the existing road network, including the construction of new flyovers and the widening of major arterial roads and highways (like the Mumbai-Pune Expressway and Mumbai-Bangalore Highway), are crucial for easing traffic flow and improving intra-city and inter-city connectivity. These improvements directly benefit real estate values in the connected zones.

- Smart City Initiatives: Pune’s active participation in the Smart City Mission involves numerous projects focused on improving urban infrastructure, digitizing civic services, and enhancing the overall quality of life. These initiatives, while broad, contribute to making Pune a more livable and attractive city, thereby positively influencing the real estate sector.

- Airport Proximity & Development: The Pune International Airport at Lohegaon plays a vital role. Areas with good connectivity to the airport, such as Kharadi and Viman Nagar, naturally attract higher demand from frequent travelers and businesses, impacting property values. Any future airport expansion or development plans will further influence surrounding real estate.

Navigating Your Investment: Actionable Insights for 2025

- Identify Your Investment Goals: Are you looking for long-term capital appreciation, steady rental income, or a property for end-use? Your goals will dictate the type of property and location that best suits your needs.

- Focus on Growth Corridors: Areas along the upcoming Metro lines and the proposed Ring Road, as well as those near expanding IT and industrial hubs (like the peripheries of Hinjewadi, Kharadi, and Chakan), are likely to offer higher appreciation potential.

- Consider a Diversified Portfolio: Depending on your risk appetite and capital, consider diversifying across residential, commercial, or even plotted developments. Mixed-use developments are also gaining traction.

- Evaluate Developer Credibility: With the market booming, it’s crucial to invest with reputable developers known for quality construction, timely delivery, and transparent dealings. Check RERA registration and past project records.

- Assess Infrastructure and Amenities: Look beyond the property itself. Evaluate the existing and planned social infrastructure (schools, hospitals, retail) and civic amenities (water supply, waste management, road quality) in the chosen locality.

- Understand Rental Yields: If investing for rental income, research the prevailing rental rates and occupancy levels in your target micro-market. Areas with high concentrations of IT professionals or students typically offer good rental yields.

- Factor in Government Policies: Keep abreast of government policies related to real estate, taxation (GST, stamp duty, property tax), and urban development, as these can significantly impact your investment.

- Long-Term Perspective: Real estate is generally a long-term investment. While Pune offers good appreciation prospects, be prepared to hold your investment for a reasonable period to maximize returns.

- Seek Professional Advice: Don’t hesitate to consult with qualified real estate advisors, financial planners, and legal experts to navigate the complexities of property investment.

The Future is Bright: Pune’s Enduring Real Estate Appeal

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Property investments are subject to market risks, and readers are advised to conduct their own research and consult with financial advisors before making any investment decisions.